Home Depot Project Loan In 2022 (How It Works + More)

|

|

LoanDepot Park in 2012

|

|

| Former names | Marlins Park (2012–2020) |

|---|---|

| Address | 501 Marlins Way |

| Location |

Miami , Florida |

|

Coordinates |

|

| Public transit |

Free City of Miami Trolley from Civic Center Marlins Shuttle [1] from Culmer |

| Parking | Four main parking garages and six surface lots |

| Owner |

Miami-Dade County |

| Operator |

Miami Marlins LP |

|

Capacity |

36,742 37,442 (with standing room) [2] 34,000 (Football) [3] |

| Record attendance |

37,446 (March 11, 2017 World Baseball Classic. USA vs Dom. Rep.) [4] |

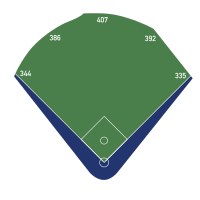

| Field size |

Left Field Line – 344 ft (105 m) Left-Center Power Alley – 386 ft (118 m) Center Field – 400 ft (120 m) Right-Center Power Alley – 387 ft (118 m) Right Field Line – 335 ft (102 m) Backstop: – 47 ft (14.3 m)  |

|

Acreage |

928,000 sq ft (86,200 m 2 ) |

| Surface |

|

| Construction | |

| Broke ground |

July 1, 2009 (Start of construction preparations) July 18, 2009 (Ceremonial Groundbreaking) [6] |

| Opened |

March 5, 2012 ( High school baseball game) March 6, 2012 (exhibition game) April 1, 2012 (spring training game) April 4, 2012 (regular season) |

| Construction cost |

US$634 million [7] ($715 million in 2020 dollars [8] ) |

| Architect |

Populous [9] |

| Project manager |

International Facilities Group [10] |

| Structural engineer |

Bliss & Nyitray, Inc (bowl and track) Walter P Moore (roof) |

| Services engineer |

M-E Engineers, Inc. [11] |

| General contractor |

Hunt / Moss Joint Venture |

| Main contractors |

MARS Contractors Inc. [12] John J. Kirlin, LLC. [13] Structal – Heavy Steel Construction, A division of Canam Group (roof) [14] |

| Tenants | |

|

Miami Marlins ( MLB ) (2012–present) Miami Beach Bowl ( NCAA ) (2014–2016) |

|

Home Depot has become the go-to store for customers working on renovation projects, offering a variety of tools, supplies, as well as project loans to fund some of the expenses.

Home Depot projects loans are a loan up to $55,000 that can be borrowed from the company as of 2022 for purchases in store or renovations. You can choose from four different tiers of the project loan. Each tier’s Term or APR will depend on your credit score.

What is a Home Depot Project Loan?

If you are unable to afford the full cost of renovations, a Home Depot loan can be a great option.

You have the option to make early repayments of your project loan, but you will be required to make monthly fixed payments.

Home Depot’s project loan does not have an annual fee and can be used to acquire all the materials you need.

What is the cost of a Home Depot Project loan?

Home Depot can provide a project loan up to $55,000. The loan is repayable in monthly installments over a period of 7 years.

You can borrow the Home Depot loan over a period of time, depending on your credit score. The APR will vary.

It is important to remember that the APR on Home Depot Project Loans are fixed over the life of the loan. There is no down payment.

What is the repayment amount for a Home Depot Loan?

The amount that you borrow to finance your Home Depot project loan will determine how much you pay monthly.

Home Depot states that the project loan repayment will not be more than $20 per $1000 spent.

Here is a breakdown of the amount you will have to pay every month, depending on how much you’ve loaned:

How do I apply for a Home Depot loan?

To apply for a Home Depot credit loan, go online to Home Depot Credit Center. You will be asked to follow the steps.

Note that it is a similar process to applying for other credit cards available at Home Depot.

Personal information is required to apply for a Home Depot loan. This includes your name, address and credit card information.

Home Depot will accept your application for a loan to finance your project. A co-applicant is required to complete their personal information.

How Long Do I Have To Use My Home Depot Project Loan?

You will have six months to purchase everything you require for your project from Home Depot using your project loan.

After you’ve been approved for the loan, your Home Depot project loan spending period starts.

How Do I Make Payments For My Home Depot Project Loan?

For your Home Depot project loan repayments, payments can be made by post, telephone, or online.

To pay by mail, you can send your checks to the Home Depot Loan Services at this address: Dept #3025, The Home Depot, P.O. Birmingham, Alabama 35287-3025.

You can also pay the Home Depot loan via telephone by dialing 877-476 3860, and follow the directions of the associate.

Home Depot can also be paid online. You can manage your account here: thdloan.com.

Can I Pay Off A Home Depot Project Loan Early?

Home Depot customers can pay their loan earlier than usual by using the Home Depot credit card.

Note that you will not have a prepayment penalty for paying off your project loan early at Home Depot.

How difficult is it to get approved for a loan from Home Depot?

It is reported that applicants for Home Depot’s project loan must be able to show proof of good credit, with a minimum score of 620.

Online reports indicate that good credit doesn’t necessarily guarantee approval for Home Depot loans.

Home Depot can provide you with a clear indication of eligibility when you fill out the application.

How do I handle a Home Depot Loan Denial?

If you are denied a Home Depot project loan, you can contact Home Depot credit services to learn why you were denied and receive advice on how to proceed.

Home Depot loyalty programs, as well as joining financing options like the Consumer Credit Card from Home Depot can be used to finance renovations.

Lowe’s, a competitor to Lowe’s, also offers similar financing and credit options for renovations.

If you are looking for the best way to apply for a loan, it is worth visiting Lowe’s, Home Depot or other similar retail stores.

Home Depot also offers credit services. You can read our post on Home Depot Pro Xtra or Home Depot Improver Card to find out more.

Home Depot’s project loan is an excellent option to fund large-scale renovations.

Although it does require a high credit score, there are monthly payment options available and no early repayment penalty. This allows you to repay quickly.

You can either pay your Home Depot Project Loan online, via postal mail or phone depending on which method you prefer. The interest rate of your project loan from Home Depot varies depending on the amount you borrow, but is fixed for the duration of your loan.

What’s the Interest Rate on a Home Depot Project Loan Loan?

7.99%

What is the Home Depot Project card?

You can use the card to get credit up to 7 years after you have paid it off if you are planning to invest in your house. For the period of 7 years, you will receive a fixed interest rate. You’re allowed to spend up to six months after you accept the offer.

Does Home Depot Have Project Financing?

Home Depot’s Project Loan is a credit card that targets customers who shop at Home Depot. It can be used to fund home improvements and services. It offers a fixed rate of interest and credit lines between $1,000 and $55,000. This loan may offer a better alternative to Home Depot’s Consumer Credit Card. Oct 26, 2021

Where Can I Use My Home Depot Project Loan Card?

Home Depot Project Loan is less restrictive than any personal loan from a bank. It operates, in a sense, like a preloaded credit card, which can then be used to make purchases at Home Depot stores and their website. It cannot be used in any other location. Jul 30, 2021

.Home Depot Project Loan In 2022 (How It Works + More)