How Do I Cancel A Tj Maxx Credit Card

Tjmaxx Credit Card

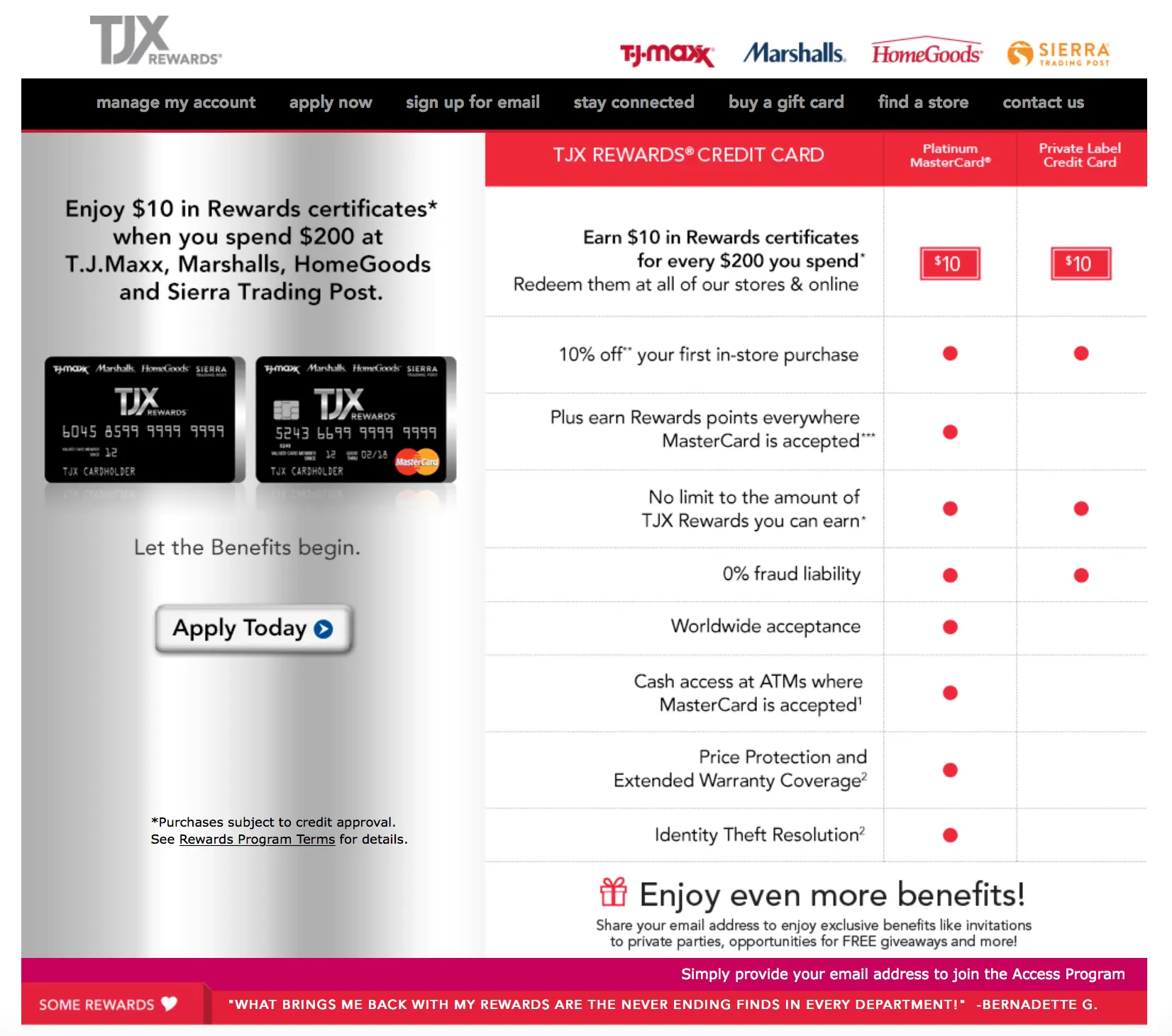

TJMAXX Credit Card for Frequent Shoppers of TJMaxx, Marshalls, Home Goods, and Sierra Trading Post. TJMAXX Users receive significant points (5x) for each dollar spent at those stores. The TJ MAXX credit card is not recommended for people who shop at these companies often due to its limited features. It is similar to other loyalty credit cards and comes with an APR of significant. There’s no annual fee.

Your TJX Rewards(r) credit card is issued by Synchrony Bank. TJX Rewards (r) is subject to the Synchrony bank Privacy Policy. The use of this site is governed by the use of the Synchrony Bank Internet Privacy Policy, which is different from the privacy policy of TJX.

J

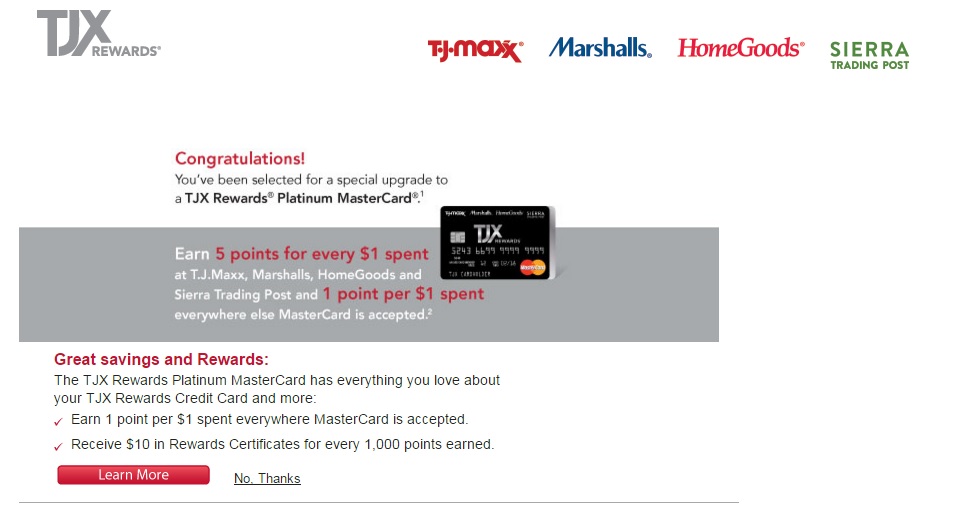

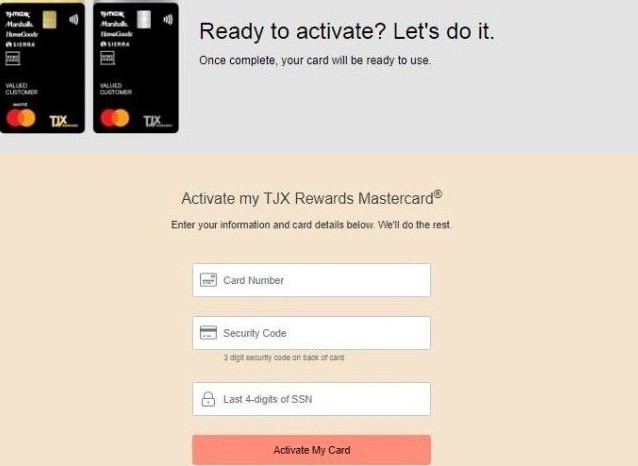

You can apply online or at any store for the TJX Rewards card, but if you have the credit score for the Platinum Mastercard, they can offer it to you. If your Platinum application is rejected, the rewards one might be available. Both can be used to earn points.

Terms and conditions for either card are the same. The variable APR (annual percentage rate) is high and can fluctuate depending on the prime rate. If the prime rate goes up or down, the APR will follow suit.

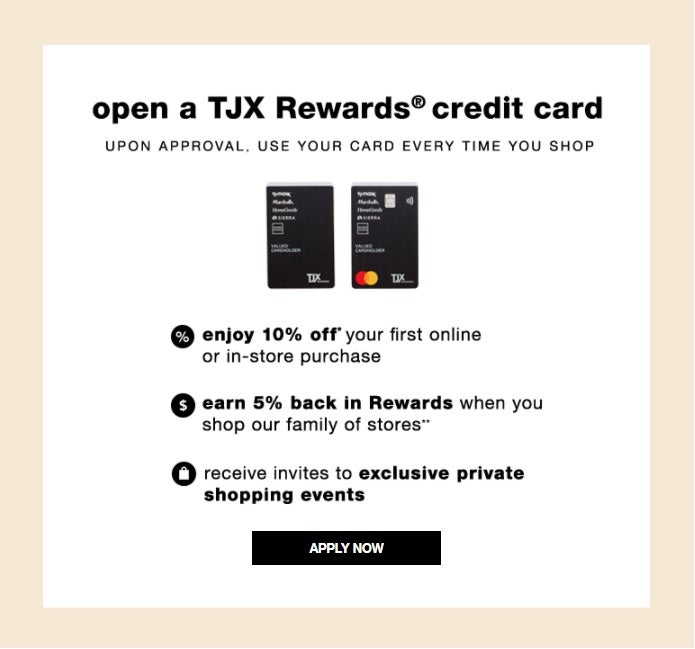

As a nice welcome bonus, you’ll get 10% off your first purchase in stores and online, once you’re approved for a TJX Rewards card. The rewards program will also allow you to start earning points. TJ Maxx will give you a $10 reward certificate when you reach 1,000 points. This can be used at Marshalls HomeGoods and Sierra Trading Post stores. Members of the Card are invited to attend exclusive shopping events.

How To Cancel Tjmaxx Credit Card

You can reach us via a variety of hotlines. After guiding you through each step, we will give you the numbers to dial if you’re in one of these countries. Below are the number of our Customer representatives that you can reach when you want to learn how to cancel TJMaxx credit card or for them to cancel the card themselves:

- TJX Rewards Platinum Mastercard – 1-877-890-3150

- TJX Rewards Credit Card – 1-800-952-6133

- Call 1300 768 913 if you’re in Australia

- Cardholders in Netherlands can call – 0107114866.

- Our cardmembers still have access to us, even if they’re not in Austria. The hotline is 01 92 87 669

- Poland is also available via landline at 022 55 10 727.

- If you are currently residing in Germany and you have an issue to complain to us or need an assistance, call 0211 88223267.

- TJMaxx Credit Card UK customer service – 01923 473561.

- TJX Canada customer service phone number – 1-800-646-9466.

- US Residents can contact an in-store representative with 1-800-926-6299 while you can call 1-833-888-0776 for any online orders related issues.

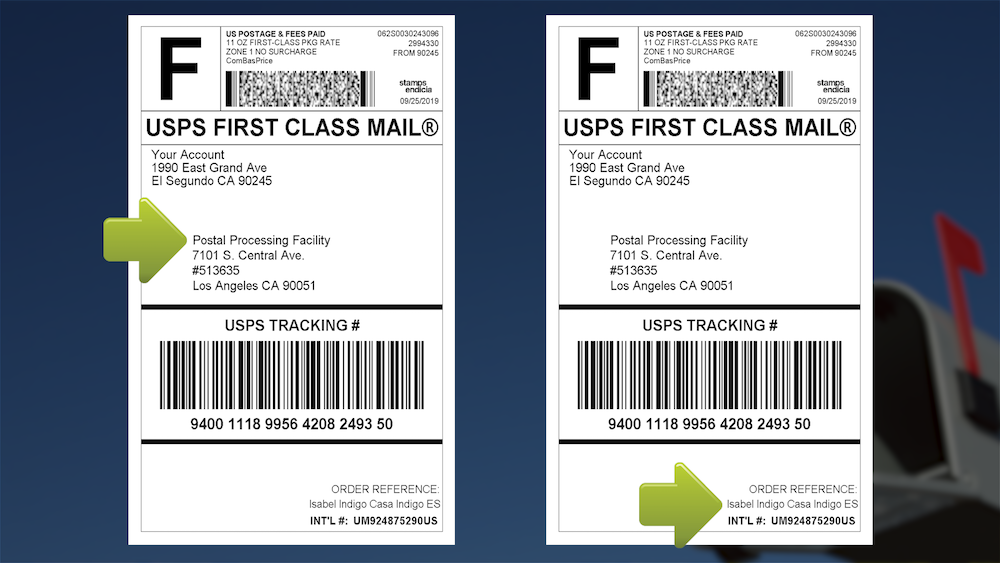

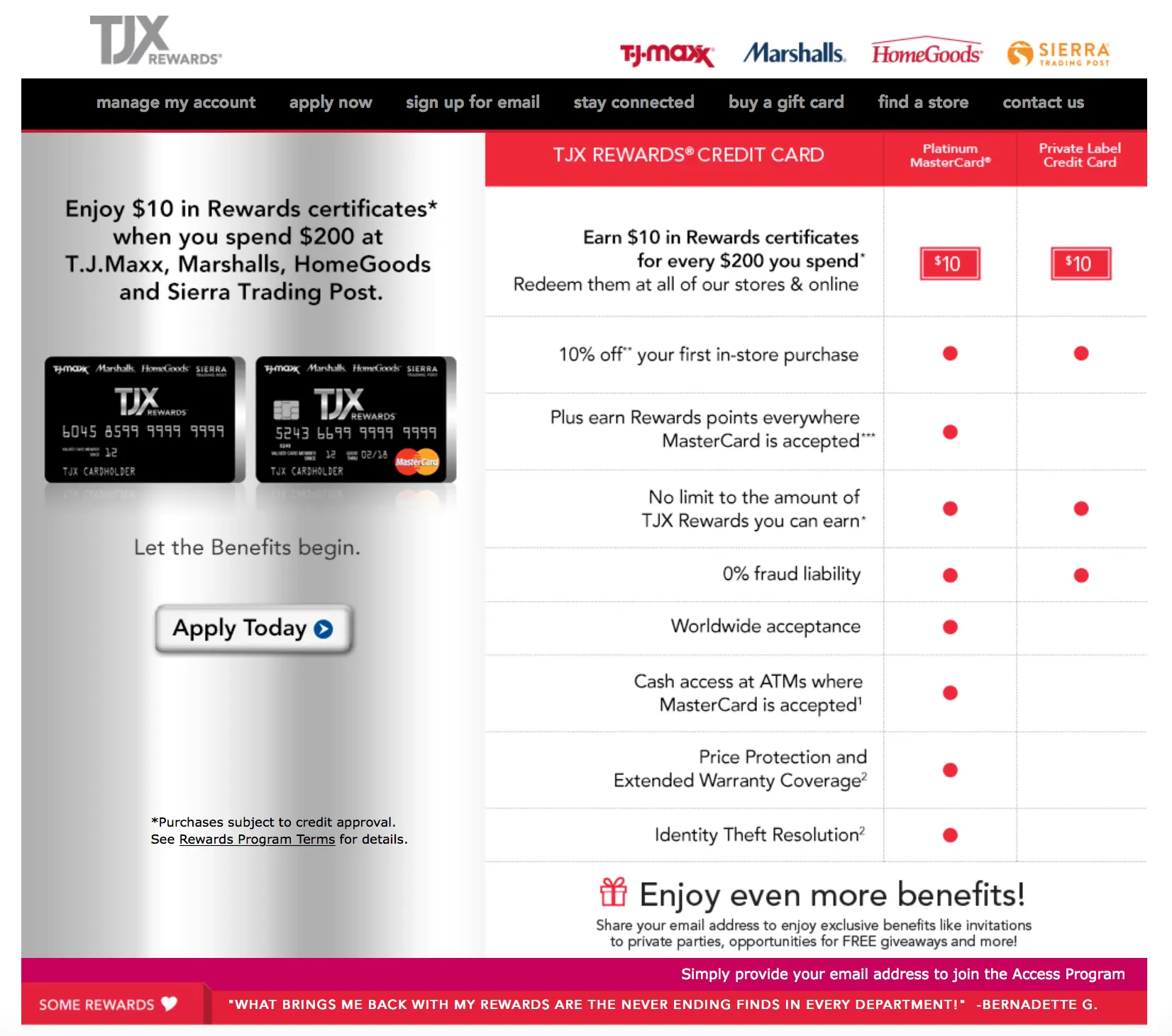

Check out the Tjx Rewards Credit Card Cards at a Glance

- 5 points per $1 spent at TJX family of stores

- Mastercard accepts 1 point for every $1 spent elsewhere

- 1000 points equals $10 in reward certificates

- 5 points per $1 spent at TJX family of stores

- 1,000 points = $10 reward certificate

The TJX Rewards Platinum Card card has a few key points you need to know.

- That’s quite a high APR. This could mean big trouble for those carrying a balance on their card.

- These cards have received a lot of negative consumer reviews on multiple websites. This is a warning sign in our books!

- We’re primarily reviewing the TJX Rewards Platinum card here, which some people often refer to as the “T.J.Maxx Credit Card.” It can actually be used to earn points across the TJX family of stores and at other retailers.

- There may be instances where applicants do not qualify for the TJX Rewards Platinum card. These applicants will be automatically considered for TJX Rewards cards.

Application for the Tjx Rewards Credit Card

You can still apply for a TJX Rewards credit cards online or in-store if you feel that one of these is the right card for you. TJX offers three cards: The TJX Rewards Platinum, TJX Rewards World, and TJX Rewards.

Shoppers submit 1 application and are initially considered for the TJX Rewards Platinum card since this card has slightly higher qualification criteria. If the applicant does not qualify, they are then automatically considered for the TJX Rewards card.

The bottom line: TJX Rewards card holders cannot directly apply for it. TJX Rewards Platinum cardholders are the only ones who can be upgraded, although specific requirements may not be listed on TJX’s website.

Some applicants are approved immediately after credit checks. There are also other cards that can be instantly approved. However, some applications may need further review, resulting in a 7 to 10 day waiting period. Additionally, applicants should note that the age requirement is 18+ years old to apply.

TJX Cardholders currently have a 10% sign-up bonus on their first purchase in-store, or online. However, there are restrictions.

High Interest Rates On A Tj Maxx Card

Like most store cards, the TJ Maxx credit card comes with a high interest rate. The card can be used wisely to build credit and avoid paying an exorbitant final price.

Take a look at how Ellen and Rebecca managed their card balances to understand the impact of card management on your bottom line.

Ellen charged $500 on her TJ Maxx credit card, and she only made the minimum monthly payments. It took her 27 months to pay the card off, at a cost of $174 in interest charges.

Rebecca charged the same amount on her credit card, but she made a monthly payment of $100. It took her just six months to pay it off. She paid $37 in interest charges.

To save significant money on high-interest items, pay off your balance quickly. To compensate for the high APR, pay the TJ Maxx credit card bill in full whenever possible.

Tjx Rewards Platinum card and Tjx Reward World card

Cardholders earn 5 points per $1 spent on the card at the TJX family of stores. These stores include:

- T.J.Maxx and tjmaxx.com

- Marshalls

- Homegoods

- Homesense

Cardholders also earn 1 point per $1 everywhere else Mastercard is accepted.

These points can be redeemed automatically for either a $10 or $20 reward voucher, depending on whether the cardholder has earned 1,000 or 2000 points. The reward certificate is only valid for use at T.J.Maxx and its sister stores (see above), either in-store or online.

Hot Tip: Depending on the promotions at the time of application, new cardholders may qualify for a 10% off coupon on their first online or in-store purchase.

J

Credit cards supplied by Synchrony Bank may be obtained at T.J. Maxx, which offers two options:

- First, you’ll have to use the TJX Rewards Credit Card, which is a store card that can only be used on-site at participating stores in the United States, Puerto Rico, or online at participating stores’ websites.

- TJX Rewards Platinum Mastercard is second. It can be used wherever Mastercards are accepted. This article will focus on the TJX Rewards Credit Card.

You can apply online for the TJX Reward Credit Card or at a TJMaxx store. If you meet the requirements for credit, the Platinum Mastercard may be available to you. If you don’t get the Platinum, you could get the shop card instead if you apply for it. Reward certificates can be earned in both ways.

Each card’s specific phrases are largely interchangeable, with a few notable exceptions. Each card has a high annual percent rate (APR), which can change depending on changes in the prime. Your APR will rise if the prime rate does. The prime rate’s decrease has the exact same effect.

You’ll earn 10% off your first online or in-store purchase if you’ve been authorized for a TJX Rewards Credit Card. You’ll start earning points as soon as you sign up for the rewards program. You may spend your $10 Rewards Certificate at T.J. Maxx, Marshalls, HomeGoods, Sierra Trading Post, and Homesense once you’ve accrued 1,000 reward points. Exclusive VIP shopping events are also offered to cardholders.

Tjmaxx Mastercard Card Vs Chase Freedom

The purchase APR is variable between 16.74% and 25.49%.

Credit score recommendation: 690 to 800

Features on credit cards

- Select new 5% bonus categories each quarter.

- Get 5% Cash Back on Bonus Categories up to $1500 Per Quarter

- Earn unlimited 1% cash back.

- Receive a welcome bonus of $150 after spending $500 within the first 3 months.

- 0% intro APR period on purchases and balance transfers during the first 15 months.

- Cash rewards do not expire as long as your account remains open.

This Chase Bank credit card allows you to choose from a variety of bonus categories each quarter. Then, you will receive cash back of 5% on purchases from those bonus categories for up to $1,500 per quarter. This offer is far superior to that offered by T.J. Maxx, as it includes almost everything (depending on which category you select).

Additionally, you will earn 1% cash back on all other purchases. You will also receive a $150 bonus on your first $500 spent within 90 days. This is much more generous than the TJMaxx MasterCard. You will also get free financing. Balance transfers and purchases within the first 15 month period are eligible for 0% intro APR. Obviously, this credit card from Chase Bank definitely beats TJMaxx MasterCard.

Final Thoughts

For many reasons, it is difficult for us to recommend the TJX rewards credit cards from Synchrony Bank.

Although the benefits seem good, cardholders cannot earn maximum benefits or use rewards certificates at TJX shops. This severely restricts your buying options.

The fees for this card, which is probably the most important aspect of it all, are ridiculous. This could lead to serious debt if you don’t know if you have the funds available each month.

The TJX Rewards credit card cards could be a great option for responsible cardholders who pay their card in full every month. If you shop regularly at TJX stores and are a good cardholder, you can still benefit. Be aware of the risks and rewards. There are so many negative reviews about these cards.

Lastly, there are several other quality cash-back rewards cards out there. Many of these cards have excellent reviews and can earn you some serious returns in big categories like groceries, gas, and even some department stores. They’re also true cash-back cards so you have the freedom to use any of your earnings however you like.

- Credit Cards

- Get in touch

- Advertiser Disclosure

Tjx Rewards(r) Credit Card Benefits And Features

TJX Rewards(r), Credit Card: Earn 5 points for every $1 spent at T.J.Maxx and Marshalls stores, HomeGoods and Sierra, as well as participating ecommerce websites that operate under the brands.

This card can be used wherever Mastercard is accepted. You will earn 1 point for every dollar. Every time you earn 1,000 points, they can be redeemed for a $10 rewards certificate that can be used at any of the card’s affiliated brands. This card does not offer cashback, so the certificate cannot be redeemed for cash. Your reward certificate will also expire two years after it’s issued, so make sure you only use your points once you’re ready to use them — otherwise you run the risk of wasting them.

In lieu of a traditional credit card bonus, the TJX Rewards(r) Credit Card gives you 10% off your first online or in-store purchase. This pales in comparison to other credit card bonuses. Some of the most popular cashback cards will reward you with 150 to $200 when you spend $500 to $1,000 within your first three months. Even if your first in-store purchase was $500, you’d only receive $50 off.

Important! The 10% discount is subject to some limitations in the credit card’s small print. The discount cannot be applied to purchases made in store if you are applying for the card using a mobile device. If you are applying on a tablet or desktop computer, the discount can be used online and in-store.

TJX Rewards Credit Card offers a variable rate of APR at 27.74% This is almost 10 percentage points higher than the average credit card APR. This APR is so high that it’s not recommended anyone ever keep a credit card balance.

Special Financing And 0% Introductory Apr Offers

TJ Maxx Credit cards are one of the very few that do not offer new cardholders special financing.

Many rewards credit cards offer 0% APR for purchases as well as balance transfers. This can help you save money if you need to transfer or pay off a card that has a higher APR.

The Discover it Card gives new cardholders a 0% intro APR for 12 months on purchases and balance transfers, and the Chase Freedom Card gives you 0% intro APR on purchases and balance transfers for 15 months.

Further, both cards start at a much lower APR when the introductory period ends.

How to Cancel the Tjx Credit card Offline

You can actually come to us directly at this mentioned addresses shown below.

But if you cannot reach us at the first address due to distance or any other reason best known to you, you can still reach us at

We will help you by discussing your problem with you. If you are still interested in going after speaking with us, we’ll arrange for that.

However, you can discover a TJX Store near you or TJX stores near your home when you go to https://www.tjx.com/stores while your GPS location is turned on. To find the nearest store, follow the instructions on screen.

Are you happy now? Use the comment box below to say your problems so that we will know how to fix it.

How do I cancel a credit card?

There are steps that you can take once you have decided to cancel your card.

- You should first make sure that your balance is cleared. This will ensure you are not subject to zombie payments after your card has been canceled.

- You can cancel any bill or recurring payments that you have made to your card.

- Redeem any remaining Rewards.

- TJ Maxx, the Customer Service Number for your card will help you cancel it. If you wish, you may cancel your card online.

- Send an email or actual letter to confirm your request to cancel your card. This will ensure that you retain a copy of the cancellation date and a paper trail in case your card is needed again.

- To prevent misuse, you can cut your card.

- Keep an eye on your credit reports to confirm that the card has been canceled.

How Important is Your Credit Score for a Tj Maxx card

The TJ Maxx credit card doesn’t offer a free monthly FICO(r) score like some other reward cards do. Instead, it’s up to you to regularly monitor your credit report and have a good understanding of your credit score. The majority of lenders use FICO(r) scores to determine how much of a risk an applicant’s history poses. These five factors are the basis of credit bureaus calculating this 3-digit score.

- Payment history (35%)

- The amount of money owing (30%)

- Credit history length (15%)

- Types of credit (5%)

- Credit expansion (10%)

Be responsible with your finances. To be creditworthy, make timely payments and keep your balances low. In addition to a higher likelihood that you receive approval for a TJ Maxx credit card, it also opens other opportunities.

About Tj Maxx

Department store company

How to Contact TJ Maxx Customer Support Team

Tj Maxx Bill Payment Arrangement

TJ Maxx Credit Card Bill Payments can be made in a variety of ways.

What is the Tjx Rewards(r), Credit Card’s Comparability to Other Credit Cards?

To figure out the true value of the TJX Rewards(r) Credit Card, it’s imperative to understand how it fits within the greater context of the credit cards market. We compared it to some cashback credit cards, which allows us to highlight this card’s strengths and weaknesses.

How To Make An Online Payment Without Logging In

You can pay your bill online if you don’t want to register or log in. Here’s how:

- Have your credit card and banking information ready, and click “Pay As Guest” on the Synchrony Bank login page.

- Your card number, last four digits from your Social Security number, and billing zip code are required.

- Continue clicking “Continue”

- Follow the on-screen prompts to complete the payment.

Apr and applicable fees for a Tj Maxx card

The TJ Maxx credit cards are issued by Synchrony Bank. There is no annual fee. Variable purchase APR (variable purchase APR) of 27.24% are based on Prime Rate. Market conditions may vary. Late payment fees can reach up to $35 and there is a $2.00 minimum interest cost.

Cardholders can use the TJ Maxx Platinum MasterCard(r) to get a cash advance. The bank charges a 23.74% to 29.99% variable APR on cash advances and a cash advance transaction fee of at least $10 or 4% of the advance amount, whichever is greater.

What is a Soft Inquiry?

Soft inquiries are when creditors check your credit without you consent. This could be a lender with whom you’ve talked to for a pre-approval quote but haven’t actually applied for a loan. Sometimes a soft inquiry might even be pulled by an existing creditor just checking on your current credit situation.

Your credit score is not affected by soft inquiries.

How can I check my Tj Maxx gift card balance online?

Check the harmony of your TJ Maxx gift voucher on the web or at any TJ Maxx retail location. The card number and security code are located on the back. If your card doesn’t have a security code, you can really investigate the balance accessible.

You can get invitations for exclusive events at TJX(r), Platinum Mastercard(r).

It’s possible to sort the merchandise ahead of other customers. You might win some prizes or treats depending on what event you are attending.

What Creditor Does Tj Maxx Use?

TJX Store Card approves mainly through TransUnion. It will still use Equifax and Experian to pull your credit reports. But don’t worry about the randomness of it. If you’re using your credit responsibly, all of these reports should reflect that.

J

You probably know that the T.J. Maxx credit card cards are issued through Synchrony Bank. The financial institution has already extended the agreement with the department store.

How Do I Cancel A Tj Maxx Credit Card In 2022? (Guide)

TJMaxx creditcards are very popular as they provide discounts on all purchases from their stores, and other affiliated retailers like Marshalls.

How can I cancel a TJ Maxx Visa Credit Card for 2022

The best way to cancel a TJ Maxx credit card is to call the Customer Service number for that card. TJX Rewards Credit card: 1-800-952-6133, TJX Rewards Platinum MasterCard: 1-877-890-3150. In 2022. To confirm, send a note or an email following your phone call.

How do you cancel your TJ Maxx Card Credit Card

To avoid any problems, it is important to cancel your TJ Maxx credit cards.

The most secure way to cancel your TJ Maxx credit card is to call it in. You can reach TJX Rewards Credit Card at 1-800-952-6133.

To cancel your TJX Rewards Platinum MasterCard, you can call 1-877-890-3150.

But before you decide to cancel your card, be sure to understand the pros and con’s of each decision.

One, your TJ Maxx credit cards will be cancelled. This will result in a decrease in credit you have available.

Further, any credit history you have built up on this card may be deleted, which can impact your credit score.

What’s the Right Way to Cancel a Credit Card?

Here are some steps to take after you decide to cancel your credit card.

You must first ensure your balance is current. If your card is cancelled, you won’t be responsible for any undelivered payments. You can cancel any bill payments and recurring payments that you have made to your card. Restricted Rewards can be redeemed. TJ Maxx is the Customer Service phone number. Your card can be cancelled online, if necessary. You can send an email, or write, to confirm that you want to cancel your credit card. So you will always have the paper record and date of cancellation for any future requests. For security reasons, it is a good idea to take out your card. Check your credit reports regularly to ensure that you have confirmed the card cancellation.

Which Bank holds the TJ Maxx credit card?

Synchrony Bank issues TJ Maxx credit card cards. This applies to both the TSX rewards Platinum MasterCard, and the TJX rewards Credit Card.

The annual fee of the TJMaxx Card Credit Card is there?

TJ Maxx credit card offers are free of annual fees, however they charge high interest rates for unpaid balances. TJX Rewards Credit Cards have a 27.99% annual percentage rate on all new purchases. A $35 late fee applies if payment is not received by the due date.

Earn Rewards, however, that you can redeem at TJ Maxx stores, Marshalls, HomeGoods or Sierra.

You get five points for every dollar you spend in store or online with your TJ Maxx Rewards credit card. When you reach 1000 points, you get a $10 Rewards certificate.

Are the TJ Maxx Credit Cards Free?

TJ Maxx Rewards Credit Cards do not charge an annual fee. If you have unpaid balances you’ll be charged an APR of 27.99%.

Does the TJ Maxx Credit Card Build Credit?

TJ Maxx rewards credit card will help build your credit.

It helps your credit score if you use it regularly and pay your monthly bills on time.

Does the TJMaxx Card Worth it?

It’s important to understand all pros and cons before you cancel your credit card.

TJ Maxx is a credit card that offers a 10% discount on purchases.

TJ Maxx Credit Cards are available in two versions: TJX Credit Card with Rewards Credit Card (or the TJX Credit Card with Rewards Platinum MasterCard).

TJX rewards credit cards can be used at Marshalls and HomeGoods as well.

Also, you can earn rewards on every purchase. TJX Rewards Platinum MasterCard acts like a MasterCard. You can use the MasterCard at other retailers and receive 1% cashback.

Both types of cards do not pay a low interest rate and earn you Rewards at a slow rate.

These are good reasons for you to cancel your TJ Maxx card. However, as mentioned above, when you cancel any credit card, your credit score will take a hit.

The reason is that when you cancel a bank card your credit line goes away, and the available credit to you drops.

You can read more about where you can buy TJ Maxx gift card, if TJ Maxx takes Samsung Pay & Google Pay and TK Maxx vs TJ Maxx.

Contact the TJ Maxx customer service line if you wish to cancel your TJ Maxx debit card. Your credit card can also be cancelled online.

It is important that you receive written or email confirmation of cancellation for your TJ Maxx debit card. Additionally, ensure your credit score is maintained to prevent any potential errors in credit reports.

How do I cancel my credit card Tj Maxx?

You can cancel your card by calling 1-877-890-3150 for the TJX Rewards Platinum MasterCard or 1-800-952-6133 for the TJX Rewards Credit Card. Please note that when you close a credit card account, the total amount of credit that you have available falls, and that puts a dent in your credit score.Mar 19, 2020

Does Closing Credit Card Affect Score?

Your credit score can still be affected by a cancelled credit card. But, remember to cancel all other credit cards before you do. You won’t lose your credit history by closing a charge-card account. Your credit history will play a role in your overall credit score.

What is the annual charge for Tj Maxx Credit Cards?

Annual fees are $0. There is no annual fee. TJX Rewards Platinum Mastercard can be used for purchases at TJX and Citi Double Cash Card – 18 months BT offers everywhere else.

Which Bank is Tj Maxx?

Synchrony Bank

.How Do I Cancel A Tj Maxx Credit Card In 2022? (Guide)