What Credit Bureau Does Lowe’S Use

Home Depot Consumer Credit Card

Home Depot Consumer Credit Card offers an offer that is similar to Lowe’s. It allows you to get a $25-100 discount on qualifying purchases (but only through 7/28/21). The two cards also offer similar special financing programs.

The Home Depot Consumer Credit Card does not offer a comparable 84-month fixed pay financing plan. The Home Depot credit card does not offer consistent rewards like the Lowe’s card’s 5% discount.

Although the Home Depot gives you an extended returns policy that lets you return items for up to a year and get a slightly lower APR (17.99%-26.99% variable), the Lowe’s Advantage Card is still the better store card choice for financing home renovations.

Rates and Fees

Financing Plans

Lowe’s Advantage Card has two available financing plans:

- No interest on purchases of at least $299 when paid in full within six months, which Lowe’s calls special financing

- Fixed monthly payments of 84 at 7.99% APR for purchases below $2,000

Lowe’s also offers limited-time financing deals from time to time. You might see no-interest offers on appliances, for example. This is if your purchase totals at least $299, and the payment is made in full within twelve months. These financing deals should be considered carefully. As we’ll see below, the special financing plans are deferred-interest offers, which is not the same as the promotional period on 0% intro APR credit cards.

How do you calculate your credit score?

Store credit cards accept those with lower credit scores than other credit cards. You may be eligible for the Lowe’s Card if your credit score is in the lower to middle 600s.

On the other hand, most of the top rewards credit cards are going to require a credit score in the “excellent” range.

People who have had problems with credit in the past, or those trying to build credit are particularly able to use the Lowe’s Card.

This benefit is one particular to store cards in general. Store cards are often the easiest of all cards to be approved for.

This is why? Retail stores are able to charge very high interest rates while keeping lending limits low. This keeps their risk low, making it easier for them to offer cards to those with lower credit scores.

And for those with credit scores? Well, if you can keep your balance low, then you can build your credit score up without succumbing to debt.

In order to improve your credit score, one major factor is your payment history.

Your score will increase if you make your payments on time each time. You won’t pay any interest if your bill is paid in full by the due date.

You can also improve your score by keeping your credit utilization low. (Credit utilization is the amount of money you owe versus how much credit you have available to you.)

If you’re looking for a way to finance your home improvement purchases and improve your credit score, the Lowe’s credit card could be a great way to accomplish both at the same time.

What Credit Score Do You Need For A Walmart Credit Card?

The Walmart Credit Card Credit Score: To be approved for the Walmart Credit Card or the Walmart(r), Store Card, you must have fair credit. That means a score of 640+. The Walmart Credit Card can be used anywhere Mastercard is accepted.

How long does it take Lowes to hire? In my experience, it takes about a week for Lowe’s to conduct a background check. Others may take longer. Lowe’s has some general guidelines. If you have any charges, be sure to indicate them on your application. Doing so you remain eligible for hire, in most cases.

How much credit do you require to get an Amazon credit card? Amazon.com Store Card requires a credit score of at least 640. This means you must have at least good credit in order to obtain an Amazon.com Store Card. The better your credit score is, the higher your approval odds will be.

What credit bureau pulls Home Depot? Home Depot primarily uses Experian and Equifax credit bureaus to verify customer eligibility for store credit cards. Home Depot will select the credit union that passes credit checks for customers who apply.

What Credit Score Do You Need For An Amazon Credit Card?

The Amazon.com Store Card credit score requirement is at least 640; this means that you need at least fair credit to get Amazon.com Store Card. The better your credit score is, the higher your approval odds will be.

What credit score do you need to open a Target card?

To be eligible for Target RedCard(tm), you must have fair credit or above 580. It’s easier than most credit cards to get the Target RedCard(tm) because it is a closed-loop card that can only be used at Target.

How high of a credit score is required to get a Kohls Card? The Kohl’s Credit Card approval requirement is a credit score of 640 or higher; this means you need at least fair credit to get approved for this card, in most cases.

How To Use Lowe’S Advantage Card

You can then use your card whenever you shop at Lowe’s. These two deals can not be used simultaneously so you will have to pick one.

If you opt for a special financing offer, make sure you can pay off your purchase before the offer ends. If you don’t, deferred interest will be charged at 26.99% regular variable APR. Similarly, if you choose fixed monthly payments with a reduced APR on any large purchases, make sure you can meet at least the monthly payments and pay the balance in full early or on time.

You should immediately pay your credit card debt, even if you get 5% off on your purchase instead of getting special financing. You will lose any savings from this discount if you don’t pay your credit card balance in full.

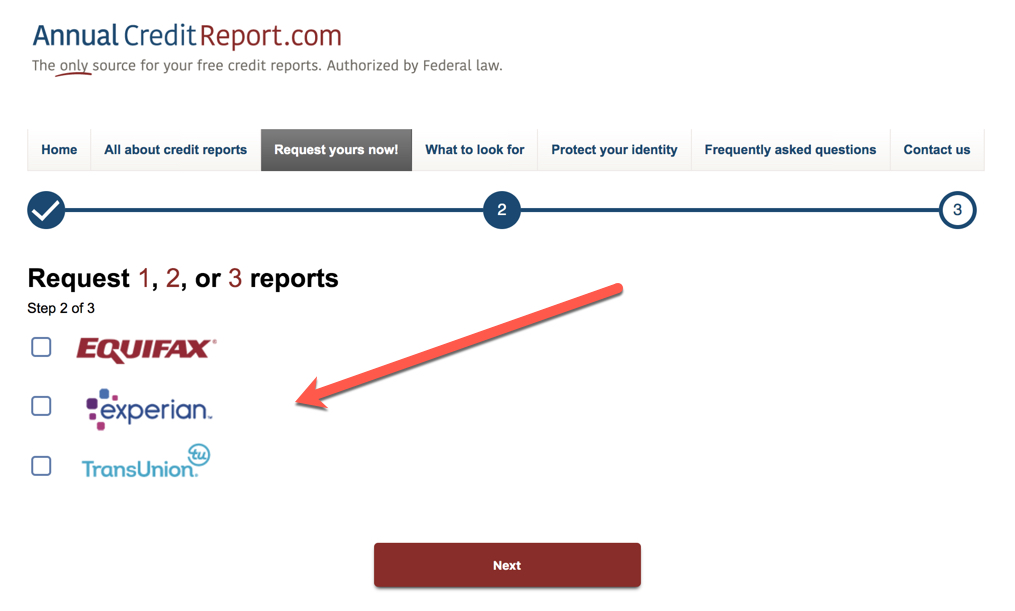

Which credit bureau does Home Depot use? Which Credit Bureau does Lowe’S use?

Both The Home Depot and Lowe’s perform a hard credit inquiry when you apply for one of their store credit cards. Hard inquiries are the credit checks that could lower your credit score. Three major credit bureaus are Experian Equifax and TransUnion. Customer service representatives at Lowe’s and The Home Depot said that both stores use all three credit bureaus when they process credit card applications.

Multiple representatives of The Home Depot’s credit service department told us that the system randomly selects the credit bureau during application. This means that you cannot know which bureau the system will use to conduct your credit checks before you apply. Approval for a Home Depot credit card is primarily determined by your credit score, the credit services representatives said, though they would not provide a minimum credit score required for approval. Home Depot store credit cards can be used wherever you are. Citigroup’s consumer credit card department could not provide additional details about the credit checks and application process.

Lowe’s credit department was also reached out to us and several representatives confirmed that Lowe’s uses a similar credit-check process as The Home Depot. When processing Lowe’s credit card applications, a credit check is randomly pulled from Experian, Equifax, or TransUnion. However, Lowe’s credit center representatives said store credit card approval is based on your payment history, credit history, and debt-to-income ratio, in addition to your credit score. Lowe’s credit cards can be issued by Synchrony Bank. Synchrony Bank could not provide additional details about the credit checks and application process.

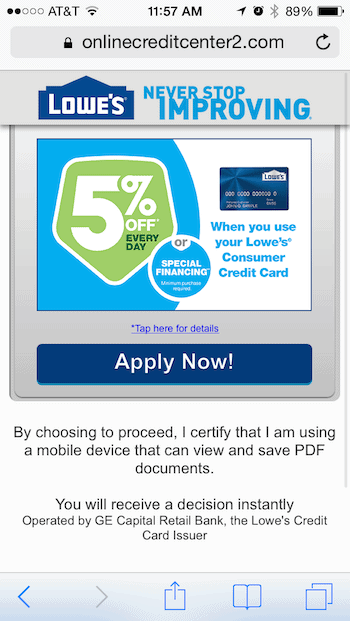

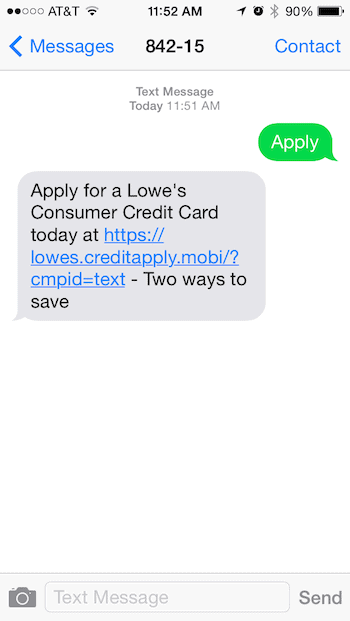

Online or in-store applications are possible for Lowe’s or Home Depot credit cards. You may be concerned about your credit rating preventing you from being approved. We have an article on how to apply for a Lowe’s credit card in-store or online.

Apply and bill pay

As with many other store credit cards, the Lowe’s card application is available online. Its bill pay services for managing your account are also available online.

This is particularly convenient for new applicants who would like to apply and get a response from their living rooms, rather than waiting in the store at the counter.

This is the standard. Think again. Believe it or not, there are store cards that still require consumers to apply in-store.

Applying in-store can be a hassle when you consider the large purchase that you may make at Lowe’s.

Do You Need A Resume For Lowes?

Job seekers looking for an employment opportunity with Lowe’s may want to consider building a resume to gain additional hiring consideration from the national hardware retail chain. A resume for Lowe’s should highlight qualifications for the preferred position.

What should I wear to a job interview at Lowes? When you’re choosing your clothes for an interview for a position at Lowe’s, business casual is generally a safe bet. For men, this means wearing khakis and a button-up shirt with slacks. It’s also appropriate to wear a dress with slacks for women or a blouse with slacks for men.

What credit score do you need for PayPal credit?

The minimum PayPal Credit Card credit score required is 700, which is good credit. You should have good credit to be eligible for the PayPal Credit card. It’s worthwhile to inquire if you frequent eBay and PayPal or eat out at restaurants.

What credit score is needed for an Apple card? What credit score do you need for the Apple Card? According to Apple, customers with a credit score lower than 600 might not be approved for the Apple Card. Apple may accept some customers with average or fair credit scores (scores between 580-6699), but others could be denied.

Annual Fee

$0

Variable APR: 12.24%-23.24%

0% intro APR for 15 months on purchases and balance transfers

Purchases and Balance Transfers: 0% Intro APR For 15 Months

- Purchases of $2,000 or more are eligible for 84 months of installment financing at a lower APR of 7.99%. With this option, you pay for the purchase in fixed monthly installments (each of which, Lowe’s says, is equal to about 1.56% of the initial purchase price). These payments will be included in your minimum amount due every month.

For purchases of more than $2,000, you can get 84-month installment financing with a 7.99% APR. With this option, you pay for the purchase in fixed monthly installments (each of which, Lowe’s says, is equal to about 1.56% of the initial purchase price). The minimum monthly payment will include these payments.

Which Credit Bureau does Lowe’S use?

- Home

- 3

- What Credit Bureau Does Lowe’s Use?

We will be discussing the What Credit Bureau Does Lowe Use?

Lowe’s Home Improvement is an American retailer company. Mooresville is the headquarters. The company specializes in home appliances. They sell holiday decorations, kitchenware and electric appliances as well as tools. You name it, anything that qualifies for home improvement, Lowe’s got it.

Lowe’s examines credit scores of customers before they approve them for store credit cards. To help them collect that information, they use the following Bureaus:

- Equifax

- Transunion

- Experian

What is it like to take out a Lowe’s credit card?

Although the Lowe’s Credit Card is certainly possible, if you have sufficient credit scores and the right information, it could still negatively impact your credit score.

However, failure to complete a credit check in order to establish your eligibility for Lowe’s credit card may result in your credit score dropping by five to ten percentage points.

Moreover, the serious credit nature of this card means that interested customers should be confident in their eligibility.

It is important that applicants remove any credit freezes or blocks before applying for this credit card.

Sears Card(r)

The Sears Card(r) and the Lowe’s Advantage Card are both options you might consider for financing high-priced items like furniture, appliances, or electronics.

The Sears Card(r) currently offers either 12-month financing on eligible items over $299–which may be better for some shoppers than the 6-month equivalent at Lowe’s–or 5% off Sears purchases. Sears offers limited-time deals like 10% discount on home appliances over $599 and specials on sports equipment, gardening tools, furniture and other furnishings.

However, given the diminishing presence of Sears stores, the Lowe’s Advantage Card will most likely be better for frequent home supplies shoppers.

Rates & Fees

- Charges

- Zins Rates

Quick Review

Synchrony Bank issues the Lowe’s Advantage card, a type of store card. It has a flexible credit limit and a variable APR that’s relatively high at 26.99%.

Lowe’s Advantage Card holders can choose between a generous 5% discount on most purchases or various special financing and fixed-pay financing offers. Although these offers may help ease the financial burden of large purchases, you need to be cautious as they could lead you to being charged interest for months.

The Lowe’s Advantage Card also offers a notable welcome bonus. New cardholders receive a 20% discount (up to $100) on their first Lowe’s purchase, with this bonus lasting until 1/31/23. This card might be worth looking into if you are planning a large Lowe’s order.

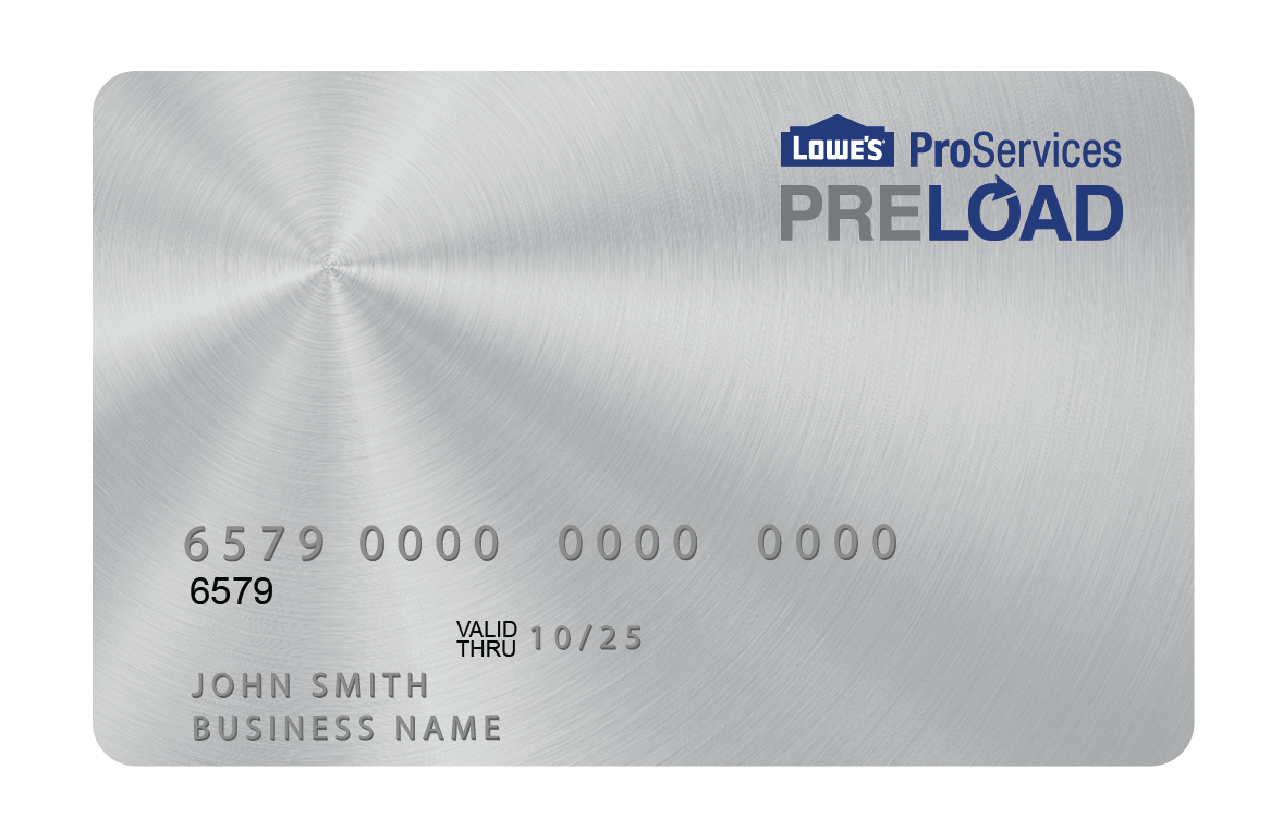

Lowe’s offers a store credit card

Yes, Lowe’s does offer multiple store credit cards.

You can then apply online for these cards or visit a Lowe’s customer service desk to get one.

Lowe’s also offers the following credit cards:

- The Lowe’s Advantage card

- The Lowe’s Business Advantage card

- Lowe’s Commercial Account

- Lowe’s Business Rewards

- Lowe’s PreLoad Discovery card

- Lowe’s Lease-To-Own card

To be eligible for the program, candidates will need to provide their Social Security Number, Contact Information, and any other details.

Further Information

- All Lowe’s Purchases Discounted up to 5%

- Different financing options available, including fixed-rate financing or special financing

- 20% off your first purchase

- Cardholders get 10% discount on select events

- Joint accounts and authorized users are permitted

Nextadvisor’S Take

- Save 5% off eligible Lowe’s spending

- Special financing offers for select purchases

- There is no annual charge

- Prequalification

- The Highest APR

- Special financing or a discount of 5%, but not both

- Store card has limited utility

How much credit do you need to buy Home Depot or Lowes products?

The Home Depot Credit Card Interest Rate is 17.99% (V), depending upon your creditworthiness. You’ll need at least fair credit – a credit score of 640 or higher – for approval. Fair credit may result in an APR at the upper end of this range.

Does Lowe’S Advantage Card Report Your Account Activity To Credit Bureaus?

Yes. Lowe’s Advantage Card will report your account activity to these credit reporting agencies.

- Equifax

- Experian

- Transunion

Regular on-time payment to creditors that report to credit bureaus can help you demonstrate financial responsibility. It may also improve credit scores.

How do I get a Lowe’s card?

You’ll likely need a fair, good, or excellent credit score to qualify for the Lowe’s credit card. Fair credit scores typically start around 600. Excellent scores begin at 800, while good scores can start in the 600s.

How can you get approved for a 550 credit score?

Credit cards and auto loans offer the best approval odds for someone with a 550 credit score. According to Equifax 2017 data, those with lower credit scores than 580 can borrow approximately 12% on car loans, compared to 6% for mortgages.

Is Lowes Home Improvement accepting Paypal?

At this time we do not currently have plans to accept Paypal, however we do appreciate your feedback which has been documented with our corporate office.

What Forms Of Payment Does Lowes Accept?

Lowe’s also accepts American Express and Visa Mastercard, Mastercard, and Discover cards.

Credit Reporting

Lowe’s partner with Synchrony Bank (a major financial institution) to issue the cards. Synchrony reports credit activity on behalf of all three credit bureaus: Experian and Equifax.

If you apply for a Lowe’s Advantage Card, you may see SYNCB (an acronym for Synchrony Bank) or SYNCB/LOW show up on your credit report. Synchrony Bank will conduct a credit inquiry to assess your credit and determine if you are eligible for the card.

Comparable Cards

Take a look at the Lowe’s Advantage Card’s performance against other credit cards to help you make a decision about whether it is right for you.

What Credit Bureau Does Lowe’S Use In 2022? (All You Need To Know)

Lowe’s offers amazing deals and customers can also apply for store credit cards that offer a range of benefits.

Lowe’s Credit Bureau In 2022

Lowe’s currently uses Equifax and TransUnion credit bureaus to determine customer eligibility for store credit cards. Lowe’s credit system will automatically pick one of these credit cooperatives for a credit review upon approval. Lowe’s credit-card customers must have a credit score at minimum 640.

Lowe’s offers a store credit card

Yes, Lowe’s does offer multiple store credit cards.

These cards can be applied online, or at the Lowe’s Customer Service Desk at your store.

Also, the credit cards that Lowe’s currently offers are:

In order to fulfill eligibility requirements, applicants will also need their Social Security numbers, contact information and any personal details.

What Credit Bureaus Does Lowe’s Use For Its Store Credit Card?

Lowe’s automatic system will approve your credit card application, and send your financial information to any of the three credit bureaus for verification.

Then, Lowe’s credit card system will randomly select Equifax, Experian, or TransUnion for the credit check.

The bureau you choose is random. There is also no way to narrow down which one of these bureaus is best for you.

Lowe’s bank credit card can also be issued by Synchrony Bank. Synchrony Bank relies on Equifax Experian and TransUnion as quality controls.

Lowes Does A Hard Credit Check

Lowe’s checks all credit applications for store cards to verify eligibility.

That said, a hard credit check involves submitting details (like your name, address, employment status, financial information) and Social Security number for a credit bureau to determine results.

You may also be able to pre-qualify as Lowe’s customer by viewing the Credit Card Page on their website.

How high of a credit score do you need to get a Lowe’s credit card?

Lowe’s credit card requires that applicants have good credit ratings in order to qualify.

Lowe’s stores credit cards require a minimum credit score of 640 points. This is determined by the credit bureau’s credit check.

Your score could be affected by Lowe’s hard credit checks if you submit a failed application.

How Difficult Is It To Take Out A Lowe’s Credit Card?

It is possible to get the Lowe’s credit card if your information is correct and you have a high credit score.

If unsuccessful, applicants may see their credit score drop by completing a Hard Credit Check to Determine Your Eligibility for Lowe’s Store Credit Card.

Furthermore, this card is very credit-intensive so interested customers need to be sure they are eligible.

To prevent denial of application, candidates should make sure that there are no credit freezes or other credit blockages before they apply for the store credit card.

What benefits are there for a Lowe’s credit card?

Lowe’s Credit Cards offer many advantages. For example, the benefits of the Lowe’s Advantage card include:

Lowe’s business advantage, Lowe’s commercial account, Lowe’s preload discover card and Lowe’s leasing-to own card are some of the cards’ benefits.

For more information, please visit Lowe’s website to find out which bank Lowe’s uses, whether Lowe’s allows American Express payments, and if Lowe’s also accepts PayPal.

Lowe’s reserves the right to randomly pick one from three credit bureaus, Experian (or TransUnion), in order determine eligibility for company’s credit card applications.

Additionally, there is no way for applicants to find out which credit bureaus the system will use to assess their eligibility.

You must have a credit score of at least 640 before you apply for a Lowes card. If your score falls below 640, the credit card may not be approved.

Lowes’ Credit Bureaus

Lowe’s uses all three major credit bureaus. They randomly select Equifax, Experian, or TransUnion to check the applicant’s credit.

How do you get low credit?

644-640 or higher

.What Credit Bureau Does Lowe’S Use In 2022? (All You Need To Know)